PHOTO: New Zealand’s property market is showing signs of serious momentum. Sarah Wood, CEO of realestate.co.nz

New Zealand’s property market is heating up with 8,769 new listings in August 2025 – up 9% year-on-year. Gisborne smashes into the $800K bracket, OCR cuts ease pressure, and spring momentum kicks in.

🌟 A Fresh Wave of Confidence in NZ Real Estate

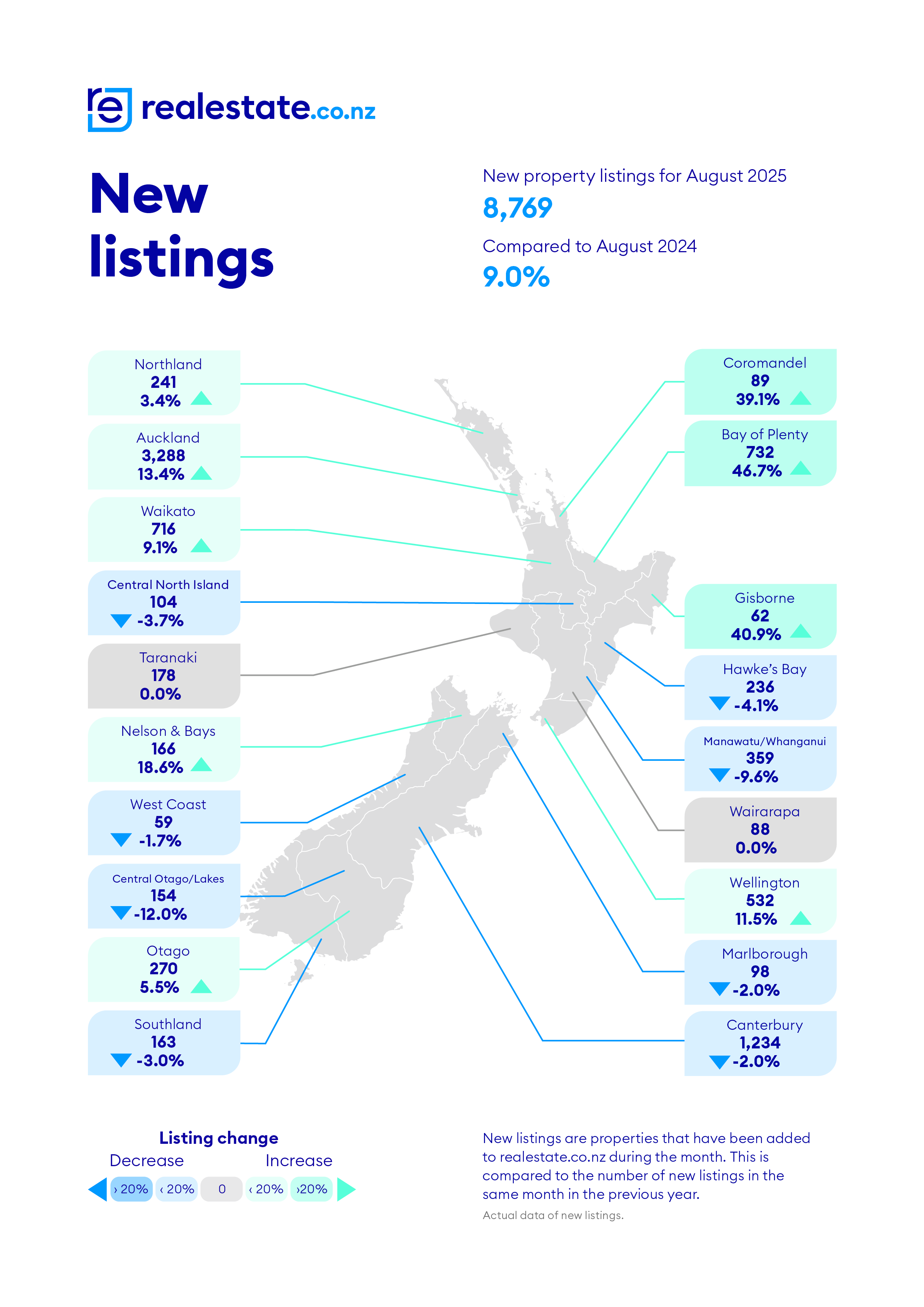

According to the latest data from realestate.co.nz, 8,769 new listings were recorded in August 2025, up 9.0% compared to August 2024 (8,048 listings).

👉 The surge in supply comes as OCR cuts ease mortgage pressure, giving both buyers and sellers fresh confidence.

Sarah Wood, CEO of realestate.co.nz, says:

“It’s exciting to see vendor confidence returning. With stable asking prices, falling interest rates, and increased search activity, the market is gearing up for a strong spring.”

https://www.propertynoise.co.nz/the-most-comprehensive-nz-real-estate-agent-database-ever-compiled-order-now-august-2025/

🏡 More Choice for Buyers: Regional Listings on the Rise

Nine out of 19 regions saw an uplift in listings compared to last year.

-

Bay of Plenty: +46.7% (732 vs 499 in August 2024)

-

Gisborne: +40.9% (62 vs 44)

-

Coromandel: +39.1%

🌱 “Spring seems to have hit early this year,” Wood added. “With over 8,500 new properties hitting the market in August, it’s the perfect time for buyers and sellers to act.”

💰 Gisborne Breaks Into the $800K Club

The national average asking price remained steady at $862,652, up 1.7% year-on-year.

But Gisborne stole the spotlight:

-

23.2% increase year-on-year

-

Average asking price $815,203 – entering the $800K bracket for the first time in 18 years

Other regions showing both month-on-month and year-on-year price growth included:

✅ Bay of Plenty

✅ Coromandel

✅ Gisborne

✅ Manawatu/Whanganui

✅ Northland

✅ Taranaki

In contrast, Otago slipped below $600K for the first time since December 2024.

📉 OCR Cuts Fuel Market Activity

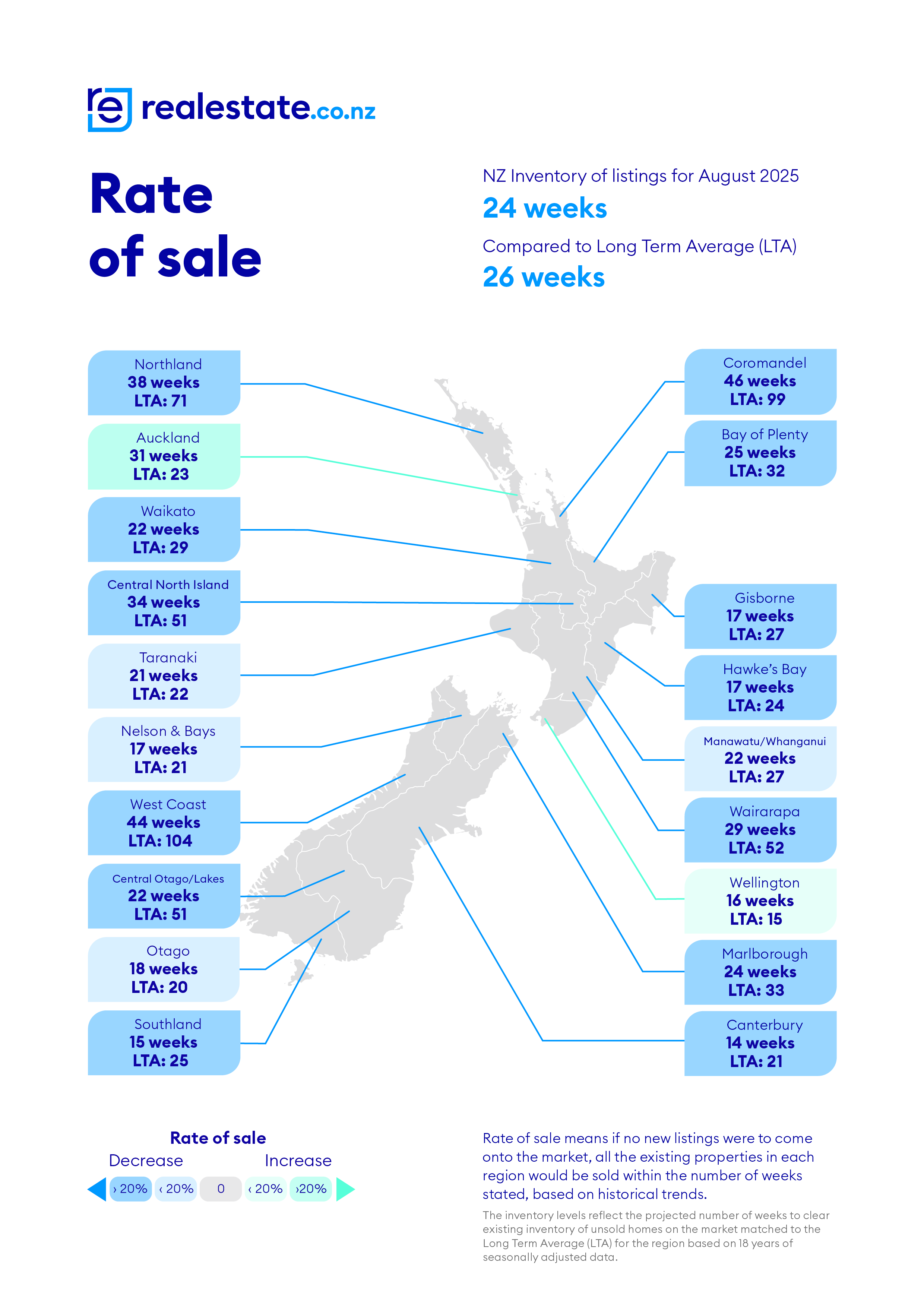

Just a year ago, the OCR was 5.25%, keeping borrowing costs painfully high. Today, with the OCR slashed to 3.0%, buyers are back with confidence, and homeowners are breathing easier.

Wood explains:

“Lower rates are creating a real window of opportunity. Steady prices and more listings mean conditions are primed for action.”

🏘️ 30,000 Homes on the Market – Regional Shifts Stand Out

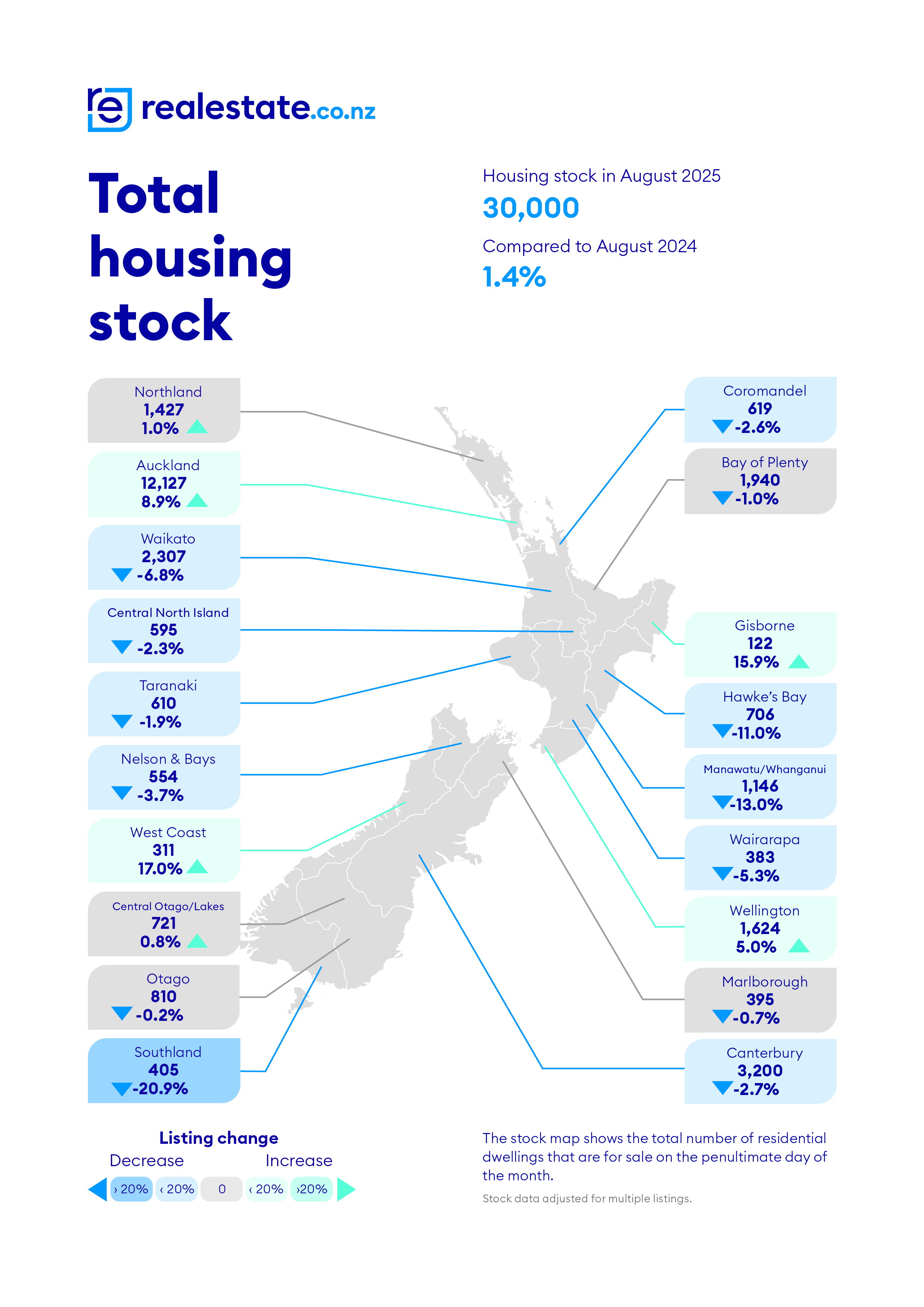

Total stock in August 2025 sat at 30,430 properties – a small 1.4% increase year-on-year.

Regional breakdown:

-

West Coast: +17.0% (266 → 311)

-

Gisborne: +15.9%

-

Southland: -20.9% (512 → 405)

📊 While stock is steady nationwide, 10 regions saw declines, showing how localised movements define the market.

🚀 The Bottom Line

With OCR cuts, stable prices, more listings, and strong regional growth, New Zealand’s housing market is heading into spring with renewed momentum.

🔑 Buyers now enjoy greater choice, while sellers can list with confidence – all signs pointing to a busy season ahead.