PHOTO: Sarah Wood, CEO of realestate.co.nz. SUPPLIED

By Property Noise NZ | Real Estate News.

The May 2025 NZ Property Report from realestate.co.nz reveals that Wellington‘s average asking price has surged by almost $95,000 year-on-year—a 12.9% increase—making it one of the strongest regional performers. This significant uptick suggests a potential shift in the capital’s property market dynamics.

Boost Your Brand with 6 Professionally Written Press Releases – Just $799+GST

📈 National Overview: Steady Growth Amid Regional Variations

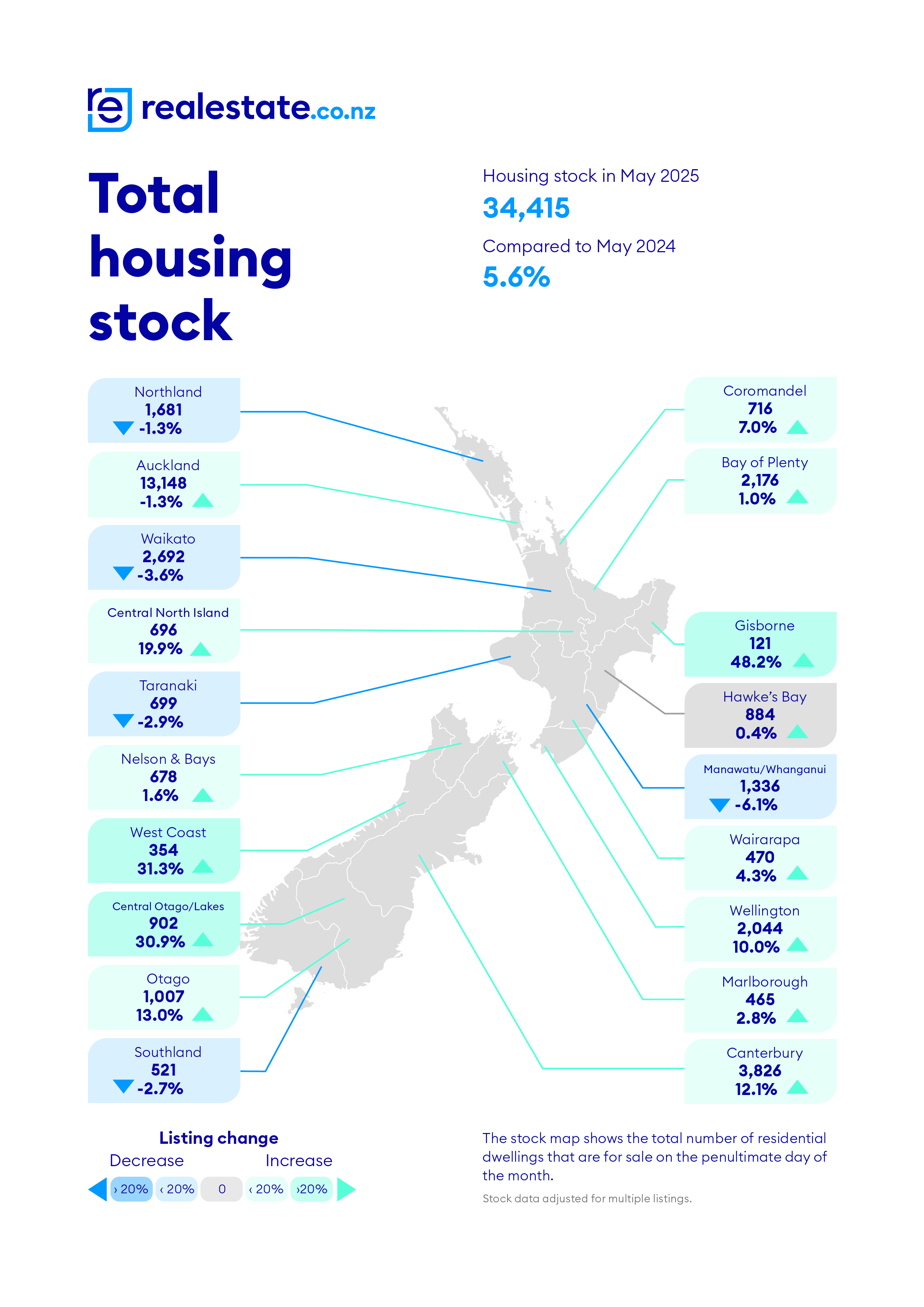

Nationally, total housing stock reached 34,415 properties in May, marking a 5.6% increase compared to the same period last year. However, regional disparities persist, with five areas—including Northland and Taranaki—reporting annual declines in stock levels.

Sarah Wood, CEO of realestate.co.nz, commented on the national trends, stating, “We still need something significant to really move the dial in the property market. Last week’s OCR drop wasn’t that, but if interest rates drop and we see more investors in the market, we’re likely to see a greater appetite for buying.”

📊 Regional Highlights: Southland Sets New Records

Southland has made a statement with a record average asking price of $564,291, an all-time high since records began 18 years ago. Other regions experiencing notable year-on-year increases include Taranaki (up 13.1% to $756,271) and Otago (up 7.4% to $645,788).

Conversely, nine regions reported year-on-year declines in average asking prices, with the West Coast down 9.8% to $494,855, Gisborne down 6.3% to $634,604, and Central Otago/Lakes District down 6.0% to $1,382,741.

🏘️ Stock Levels: Signs of Movement in Select Regions

While the national stock levels have increased, all 19 regions reported month-on-month decreases in stock levels, with the most significant decline observed in Gisborne (16.3%). These regional dips could suggest that some of the higher stock levels seen over the past year are beginning to clear.

Wood noted, “These regional dips could suggest that some of the higher stock levels we’ve seen over the past year are finally starting to clear. It will be interesting to see whether this trend continues, especially as recent changes to the OCR begin to influence the market.”

🆕 New Listings: Seasonal Patterns with Regional Variations

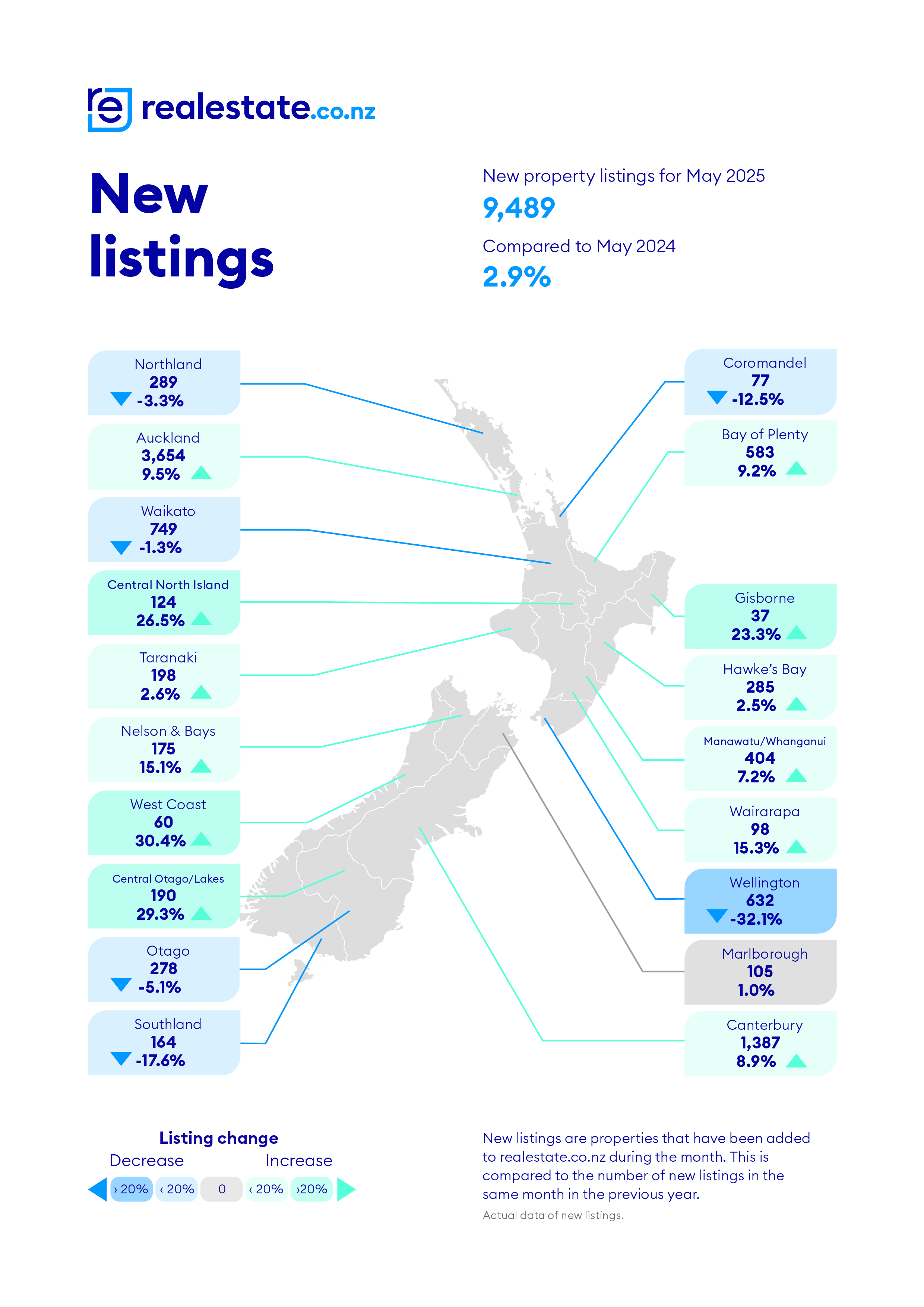

New listings were up nationally by 2.9% year-on-year, following seasonally expected trends. Thirteen of the 19 regions saw an increase in new listings, with the West Coast experiencing the highest increase at 30.4% year-on-year. In contrast, Wellington saw a significant decrease in new listings, down 32.1% compared to May 2024, potentially contributing to the rise in average asking prices.

🔮 Market Outlook: Awaiting Further Economic Indicators

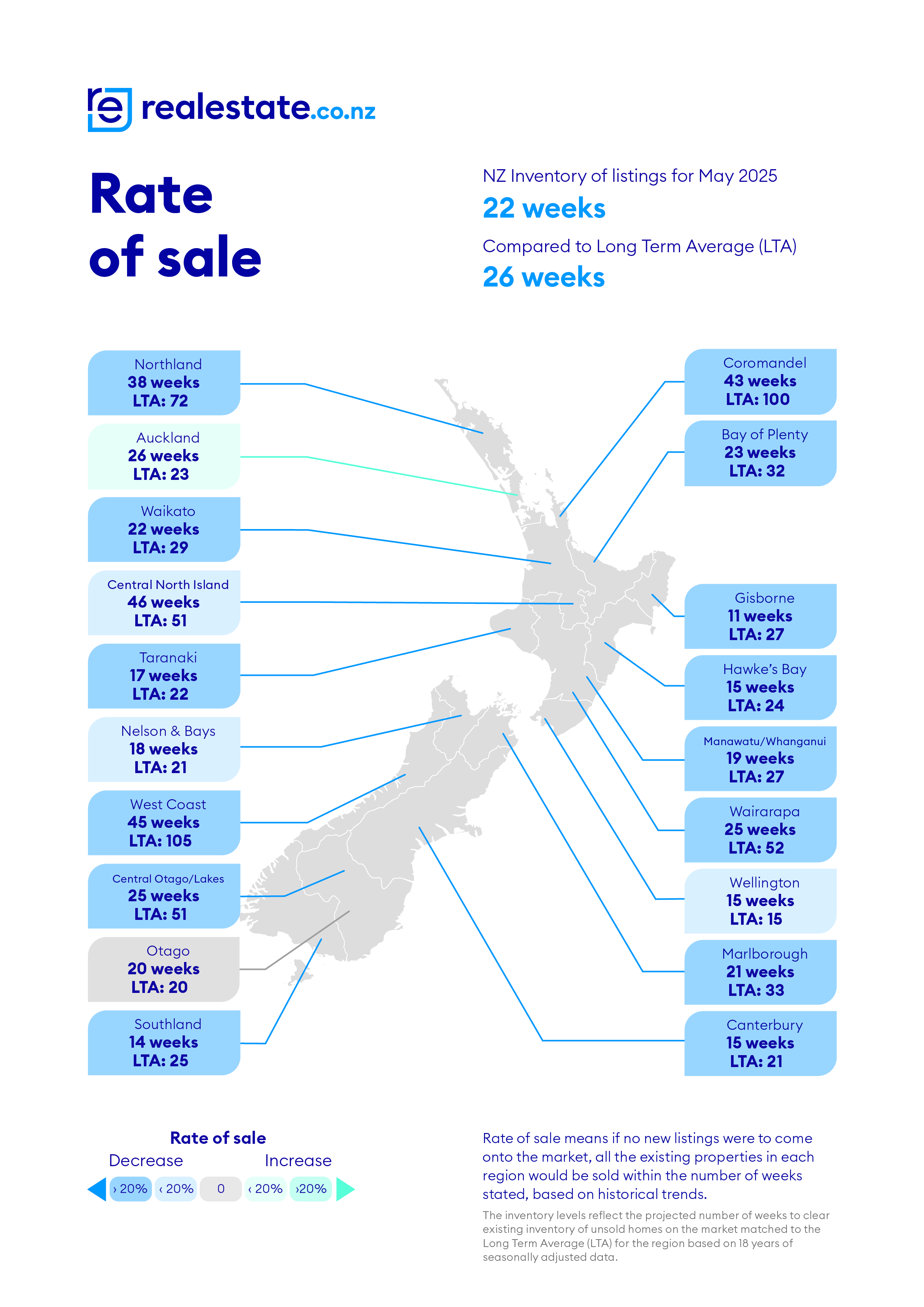

The current data suggests a market in flux, with certain regions like Wellington showing signs of renewed activity. However, the overall national market remains steady, awaiting more substantial economic shifts to drive significant changes.

“We’ve had over two years of price stability and there’s no sign of real change just yet,” said Wood. “Where does this put us in the property cycle? It’s hard to tell as immigration isn’t supporting a growing market at present, so we continue to remain in a holding pattern, waiting for either demand to rise or economic indicators to shift before we see meaningful movement.”

SOURCE: REALESATATE.CO.NZ