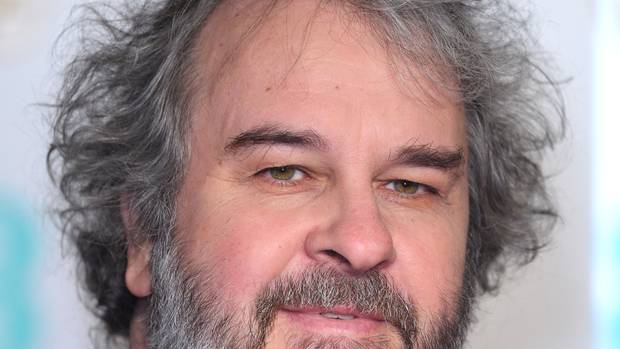

PHOTO: Olly Newland says investing in property is a long game. RNZ

A seasoned property expert, Olly Newland, known for his 2004 book “The Day The Bubble Bursts” and other publications, suggests that it may take several years before property prices experience substantial growth once more.

Newland emphasizes the importance of recognizing that the property market is a long-term endeavor, stating, “I believe it will remain relatively stagnant for some years, potentially three, four, or even five years before we witness another significant upswing. People should temper their expectations regarding making substantial gains in the property market over the next few years. A longer-term perspective is essential.”

Sofia Vergara owns her and Joe Manganiello’s entire $44M property empire | WATCH

While house prices surged by approximately 30% in 2021, they have since declined by about 18% from their peak levels. Newland anticipates that the market will stabilize from this point forward.

Expressing some apprehension about post-election economic revelations, he remarks, “I’m cautious that after the election, the actual state of the economy will become apparent. I believe the authorities are attempting to keep everyone content, but the reality of the situation might become evident after the holiday season. I’m adopting a wait-and-see approach.” He advises property investors to exercise patience and be prepared to wait.

Newland notes that prices have notably decreased at the higher end of the market, citing an instance where a couple relocating to New Zealand acquired a property valued at $3.2 million for just $2.2 million. He also highlights that while quality properties are still selling, they are doing so at reduced prices, and there are enticing bargains available.

‘Don’t play stupid’: Twist in real estate agent sacking drama | WATCH

In his book, Newland outlined various indicators of potential property market weakness, such as an increase in properties being advertised for rent. He also mentioned a shift away from tender or auction listings toward properties with fixed prices, a trend noted by Trade Me.

Newland suggested that other signs of market fragility include incentives or gifts offered to buyers of new homes and aggressive marketing by “get rich quick” schemes.

Regarding the impact of new home prices on existing properties, he acknowledged that the 15% Goods and Services Tax (GST) component played a role.

However, another property expert, Kieran Trass, author of “Get Rich with the Property Cycle” (also published in 2004), has a contrasting perspective. Trass believes that market volatility persists, and there will be another price surge in the coming year. He attributes this to the power of emotion, suggesting that periods of panic buying and fear-driven market pauses have been influential in recent years.

Trass anticipates a return to panic buying, driven not solely by low interest rates but also by fundamental factors. He emphasizes that historically, sales volumes precede changes in property values, and when sales volumes increase, the market tends to experience a period of frantic buying.

He also points out that the market is emerging from a confidence crisis caused by efforts to combat inflation, and the supply-demand equation has evolved significantly in the past 18 months.

Trass notes that a reduction in new construction starts, higher construction costs, a credit crunch, and increased interest rates have affected supply. This, combined with a recent influx of net migrants, is putting pressure on housing supply. He believes that this supply-demand dynamic may not be fully appreciated yet, as many new builds are still in progress.

Sacked real estate agent: ‘I am not sorry for telling the truth’ | WATCH

Even if net migration levels decline, Trass expects them to remain relatively strong for some time, as migration trends tend to be stable. He also suggests that there are valid reasons for seemingly high property prices, particularly in Auckland, where changes to the Unitary Plan have increased the number of homes that can be built on sections, influencing the value of land plots.

In summary, Newland offers a cautious outlook for the property market, advocating patience, while Trass believes that market volatility may continue, driven by emotional factors and supply-demand dynamics.

SOURCE: STUFF

REVEALED: ‘MOVERS AND SHAKERS’ of the NZ real estate industry | 2023