PHOTO: Why Property Prices Are Still Tumbling Despite Falling Mortgage Rates. FILE

🔻 The Crash Is Still Happening

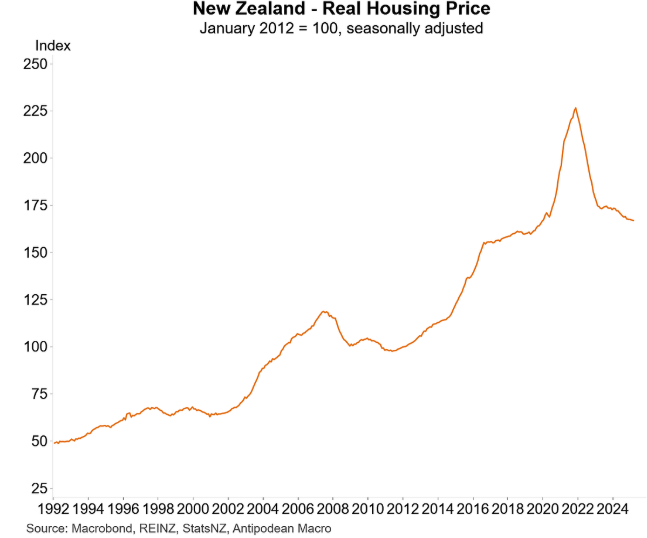

New Zealand’s once red-hot housing market continues its downward spiral. Despite one of the biggest booms during the COVID-19 pandemic, the country is now experiencing one of the deepest corrections in the developed world.

According to the REINZ house price index, real inflation-adjusted property values are now back to pre-pandemic levels. This was reinforced by economist Justin Fabo of Antipodean Macro, who confirmed the slump is both wide-reaching and long-lasting.

📊 New Data Confirms the Ongoing Slump

The latest Cotality report (May 2025) paints a grim picture:

-

📉 House prices fell 0.1% in May

-

📉 Down 1.6% year-on-year

-

📉 Down 16.3% from the market peak

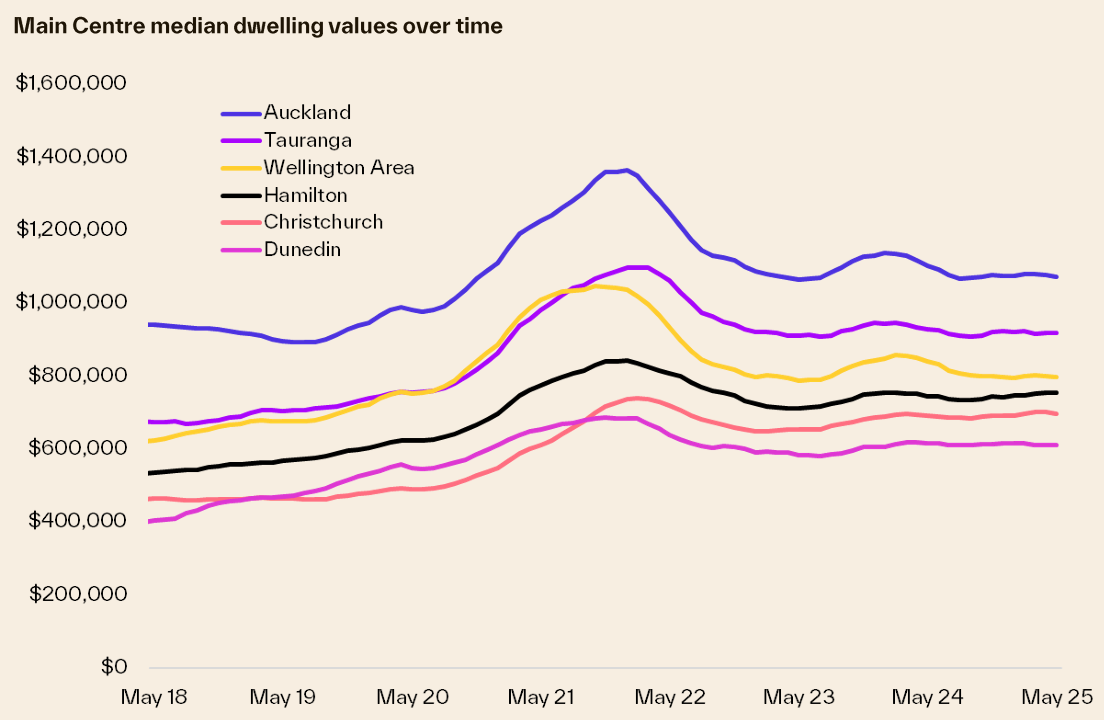

💥 Regional declines since peak:

| City | Price Drop |

|---|---|

| Auckland | -21.4% |

| Wellington | -23.9% |

| Canterbury | -13.2% |

Every major centre is feeling the pain.

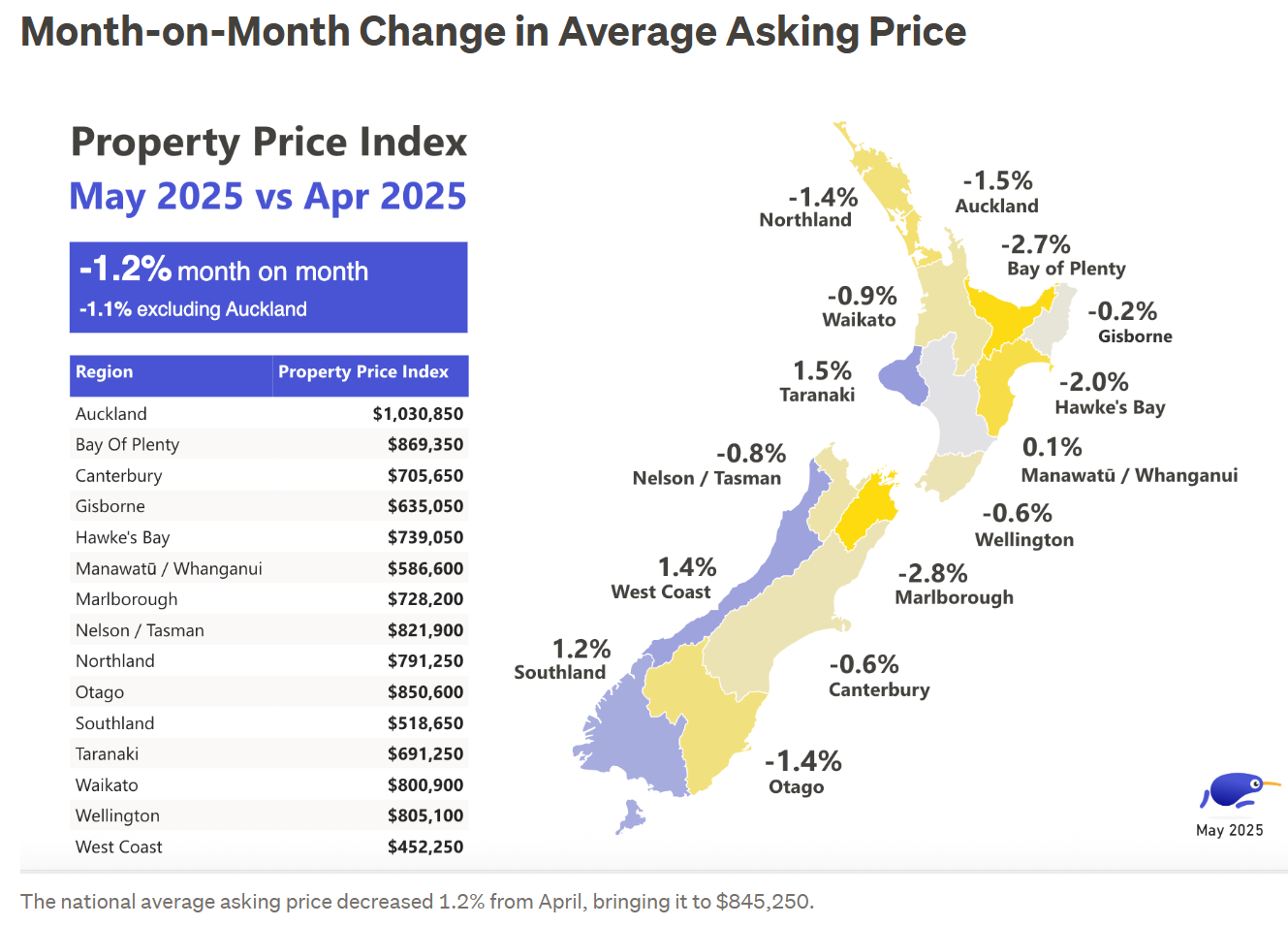

🏷️ Asking Prices Hit 8-Month Low

According to TradeMe’s latest Property Price Index:

-

📉 National average asking prices dropped 1.2% in May

-

📉 Following a 0.8% drop in April

-

📆 Median days on market rose to 70 in May (up from 62 in April)

Even typically stable regions like Canterbury are seeing downward pressure, with May showing the lowest average prices since September 2024.

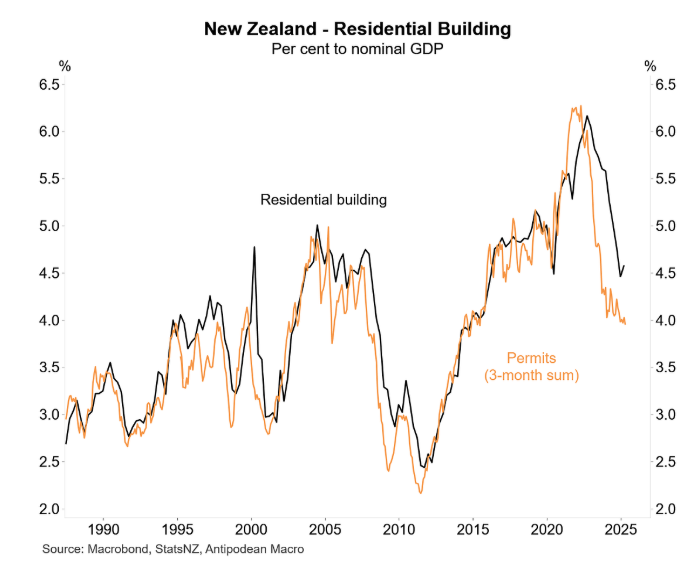

🏗️ Construction Activity in Freefall

As demand evaporates, construction has collapsed.

According to major bank ASB, “construction activity has been surprisingly frail”—even after the RBNZ cut interest rates by 2.25%. This suggests a serious lack of developer confidence in market recovery.

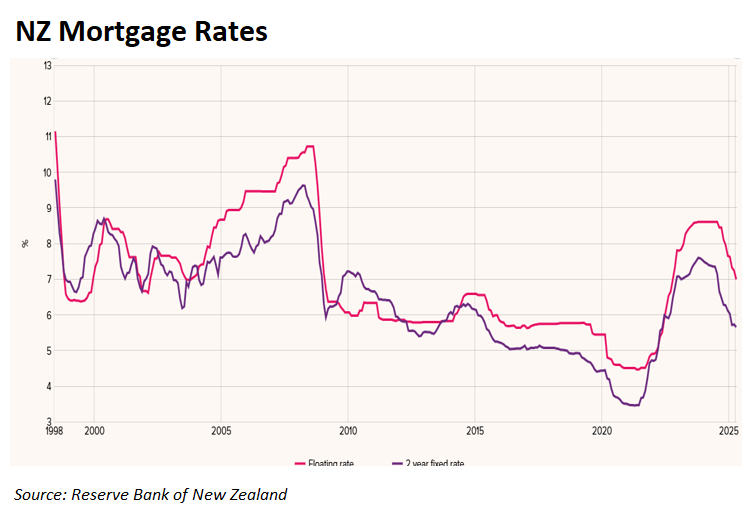

💰 What About Mortgage Rates?

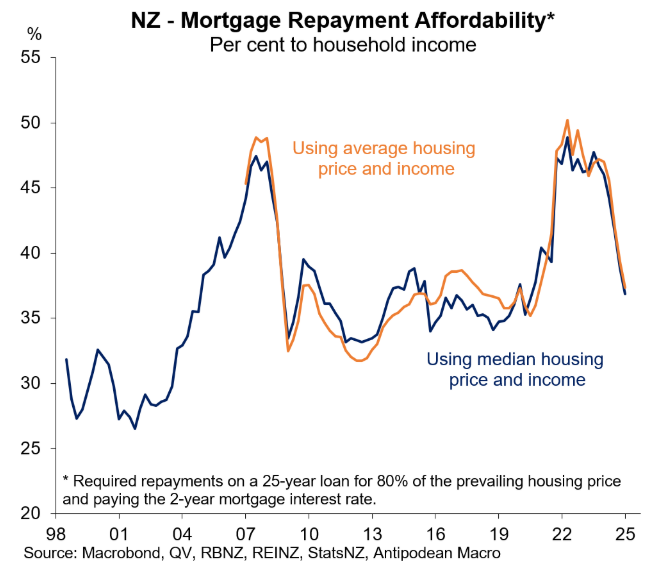

Falling interest rates have eased the pressure for borrowers:

-

🏦 Mortgage payments as a % of household income have dropped from 50% to just 35%

-

🧾 Yet affordability isn’t translating to increased buying activity

Cotality’s Chief Property Economist, Kelvin Davidson, said it plainly:

“Anyone expecting a rebound in prices in 2025 is going to be disappointed.”

✅ Good News for Buyers (Bad News for Sellers)

Buyers now hold the upper hand:

-

📉 Vendors are discounting

-

🏡 Inventory remains high

-

🧮 Affordability has improved

But sentiment is still fragile. Davidson notes many buyers remain “hesitant to engage” despite favourable conditions.

🇦🇺 Unlike Australia, NZ Is Becoming Affordable Again

Unlike Australia, where affordability continues to deteriorate, New Zealand is finally becoming a buyer’s market—with prices, mortgage stress, and competition all easing.

But without a surge in confidence or population growth, don’t expect a boom any time soon.